ERMA as a Product

ERMA as a Product is a way for banks to use our streamlined and proven process to perform executive-oriented Community Bank enterprise risk management themselves. Community Banks benefit from our risk and document inventory, scoring process, web-based dashboards, automated data feeds, and customer service & training:

Risk and Document Inventory

Risk and Document Inventory

Our Community Bank Risk and Document inventories allow you to focus on the risk assessment process without needing to reinvent the wheel. Standardized risks and documents span and are organized by the following Risk Areas: Strategic Risk, Credit Risk, Liquidity and Interest Rate Risk, Compliance, Information Technology and Operational Risk. The documents include audit, governance, policy & procedure, regulatory and report documents that already exist at your Community Bank, and they already largely encode the risk content at your bank.

Scoring Process

Scoring Process

Additionally, the inventories are structured to streamline the assessment process. Each risk is already pre-scored on an inherent risk basis based on the typical Community Bank, so you can focus on the people, process, product and technology mitigants specific to your institution that would inform your residual risk. For an even quicker scoring process, we also allow Banks to broadly characterize a particular risk or risk aspect relative to other Community Banks — i.e., average, best case, worst case — and this will automatically modulate your risk scores across a pre-defined and bounded path in both the Impact-Likelihood Matrix and Risk Stoplight.

Web-based Dashboards

Web-based Dashboards

The heart of the ERMA solution (whether as a product or as a service is the interactive, web-based dashboards which graphically present and allow interaction with the risk inputs and results in a fashion that lets Community Banks cut through the noise and focus on relevant and interesting results. For example, risk results are automatically compared over time to allow banks to dynamically filter to risks that are trending worse.

Automated Data Feeds

Automated Data Feeds

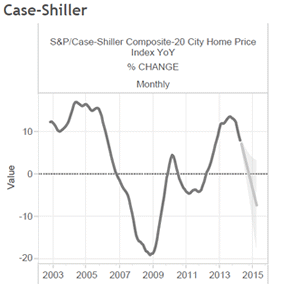

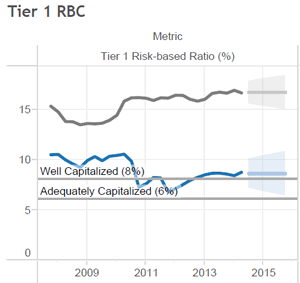

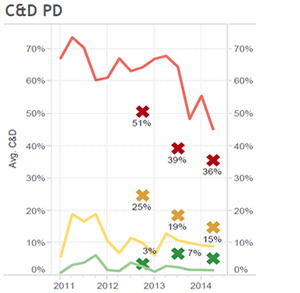

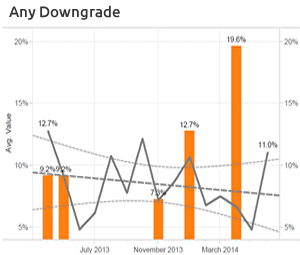

One of the challenges of enterprise risk management for Community Banks is accessing, updating, wading through and interpreting all of the various indicators of and inputs to risk at your bank. ERMA solves this by automating the following data feeds and providing longitudinal analysis, funnel-based forecasts and peer comparisons to aid interpretation:

Customer Service & Training

Customer Service & Training

Because we also offer ERMA as a Service during which we perform the risk and document assessments as a consulting-based service, we have experience in the trenches of enterprise risk management for Community Banks. Should you encounter challenges or have a question with ERMA as a Product or even if you want assistance assessing a particular risk or document, we can bring to bear the same ERM experience and banking domain expertise.