Executive Risk Management Analytics (ERMA)

For Bankers, By Bankers

Properly done, Bank ERM enables risk management efficiencies, strategic planning improvements, and an avenue to improved coordination, communication and relationships with bank constituents (board members, regulators, etc.).

Too often, though, well-intentioned bank ERM initiatives either fail outright or become time sinks while resources get caught up trying to launch ERM from scratch without guidance and / or co-opt over-wrought, audit-oriented tools and methodologies that are appropriate for SOX and financials but wholly unsuited to ERM.

That's why we have developed a different way — a streamlined ERM solution created for bankers by bankers. Our Executive Risk Management Analytics (ERMA) does not require adding resources on your end. You can focus your energies reviewing and interacting with your ERMA results via a web-based dashboard, and we'll do the heavy lifting behind the scenes: scoring a standardized banking risk inventory through the use of advanced analytics, extensive document review, and, only after those activities are complete, targeted interviews with key management.

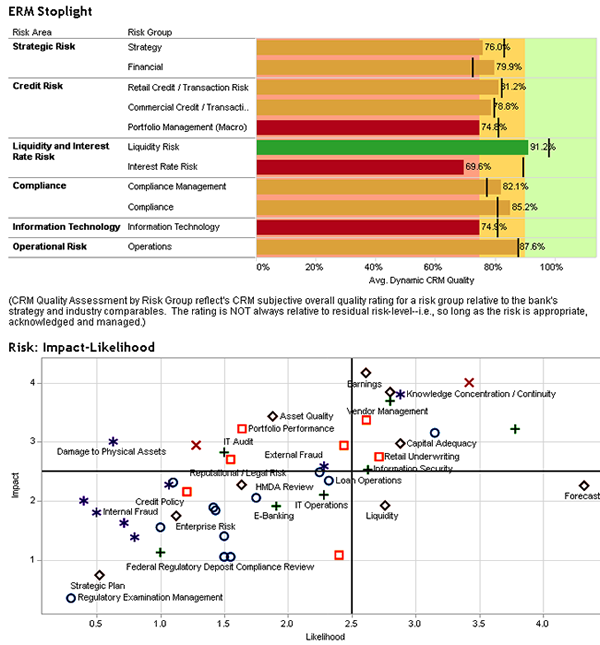

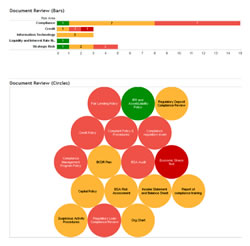

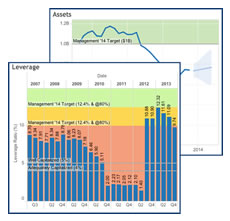

The result is a living-and-breathing document which we collaboratively maintain and update in concert with your strategic plan, management response plans on “high-high” risks, and regular updates to your key business and governance documents.

Streamlined • Simple • Strategic

- Time-efficient: non-burdensome to staff (± 2 day on-site)

- Leverages our 25 year history and domain experience

- Comprehensive management and board training

- Customizable community bank risk inventory

- Interactive web-based dashboard

- Point-in-time and trend analysis

- Strategic risk management

- Executive-oriented

- Top-down

An Executive-oriented, Top-down Approach to Community Bank ERM

- Credit Risk Migration Analysis — Estimation of Loss / ALLL

- Remote External Loan Review

- Balance Sheet and income Statement Stress Testing (Capital & Liquidity Impacts)

- Compliance Review

- Advisory Services: Strategic Planning

- Advisory Services: Capital Planning

- Advisory Services: Credit Process Consulting

- Advisory Services: IRR

- Secure cloud-based deployment (SaaS / ASP) (no hardware or software purchase)

- All traffic encrypted by SSL

- All Traffic IP-controlled

- HTML5 results optimal for viewing / interacting on any web browser including on tablets

Call us at 1-888-600-7567, or complete the form below.