Concentration Analysis

Concentrations in Loan Portfolios continue to get regulatory scrutiny:

“During 2016, supervisors from the banking agencies will continue to pay special attention to potential risks associated with CRE lending. When conducting examinations that include a review of CRE lending activities, the agencies will focus on financial institutions’ implementation of the prudent principles in the Concentration Guidance… relative to identifying, measuring, monitoring, and managing concentration risk….” SR 15 17 (Dec 2015)

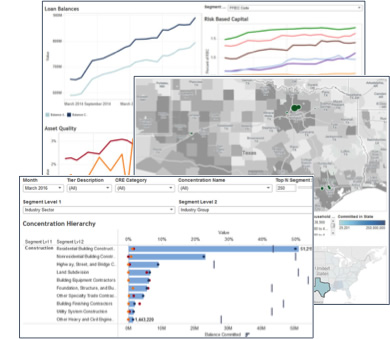

Our Concentration Analysis solution helps banks address their concentration risks and this special attention from the regulators. More than just a regulatory check-the-box, our interactive analytics allows your bank to leverage concentration management as a living-and-breathing portfolio and risk management tool. We incorporate metrics spanning Risk Based Capital, Growth, underwriting, pricing, loan review, asset quality, ALLL and stress testing, and we do this not just at the regulator-recommended segmentations of product, industry and geography but by ANY loan attribute—e.g., branch, relationship manager, vintage, etc.

Concentration Analysis Key Benefits:

- Provides the Bank insight on key concentration risks

- Follows regulatory injunctions to monitor RBC, Growth & Asset Quality and segment by product, geography and industry

- Interactive analytics forms the basis for risk and portfolio management of your loan portfolio

- Strategically important to executives and tactically relevant to front-line managers and loan officers

- Integrates with ALLL, Loan Review & Stress Testing activities

Have a look at our other quantitative solutions:

Credit Risk Migration Analysis Portfolio Stress Testing ALLL Estimates CECL Impact AnalysisCall us at 1-888-600-7567, or complete the form below.

CRM_A’s Concentration Analysis product has allowed us to take our Concentration Management process to a whole new level. This product allows us to look at our concentrations on a granular level and a portfolio wide level… CRM_A’s product has helped us to exponentially increase our knowledge of the concentrations within our loan portfolio. It will help us ‘write our story’ for bank regulators and for investors who have questions about concentrations and how they impact our bank’s overall credit risk …

Ion Mixon, EVP CRO

The First, A National Banking Association