CRM_A® — Credit Risk Migration Analysis

Underwriting changes, portfolio shifts, and the business cycle conspire to confound standard loss forecasting. Reverse engineer your portfolio data to enable more prescient stress testing, trend analyses and loss and reserve estimates.

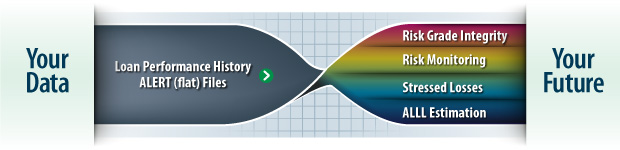

Your Data. Your Future.

Welcome to CRMA (Credit Risk Migration Analysis). Our technology delivers a quantum leap over traditional forecasting models that rely on historical net charge-off rates. Our difference is CRMA, which deep dives into your loan data to develop institution-specific Probabilities of Default ("PD") and Loss Given Default ("LGD") metrics. Our process leverages your historical performance, but adapts to your portfolio's changing risk profile, to model the most accurately predictive scenarios.

CRMA …

Relied on by banks and credit unions. Trusted by top due-diligence advisors.

Accepted by accountants and regulators. Validated by mathematicians. Back-tested.

- Highly probative, highly predictive

- Adaptable across multiple applications

- Flat file to function — turns your data into decision insight

- Enables smarter loan underwriting and pricing

- Fully auditable

Have a look at our quantitative solutions:

Portfolio Stress Testing ALLL Estimates CECL Impact Analysis Concentration Analysis

Call Now for a Consultation.